India’s asynchronous motor market demand is increasing rapidly, outpacing other Emerging Asian motor Markets in the Asia-Pacific region. The annual growth rate stands at 7.89%, and in 2024, the market is valued at USD 796.61 million. Asynchronous motors are essential for improving energy efficiency in large factories and commercial buildings. The rise in factories, enhanced energy management, and the adoption of electric vehicles are all driving asynchronous motor market demand. Across Asia-Pacific, there is a strong demand for asynchronous motor technology, reflecting a growing focus on energy savings and automation. India’s market is particularly notable for its contribution to energy conservation, as energy-efficient asynchronous motor solutions can reduce energy consumption by up to 30%. When comparing India to other Emerging Asian motor Markets, it’s clear that each market is experiencing unique growth patterns, which will shape the future of the asynchronous motor market demand in the Asia-Pacific region.

Key Takeaways

India’s asynchronous motor market is growing quickly. It grows at a 7.89% yearly rate. The market is worth almost $800 million in 2024. Growth happens because more factories are being built. Energy efficiency rules also help. More people are using electric vehicles too. Asia Pacific is the leader in the world market. China and India are the top countries. They both focus on saving energy and smart motor technology. There are some problems like strict rules and supply chain troubles. There is also a lot of competition. But new ideas and automation bring chances for growth. Smart technology and renewable energy projects help the market grow. Government support also helps companies stay strong.

Market Overview

Market Size

India’s asynchronous motor market has grown a lot. In 2024, it is worth USD 796.61 million. The global asynchronous motor market is worth USD 8.5 billion. It may reach USD 12.5 billion by 2033. The asia pacific induction motor market is the biggest region. It makes up 40% of the world’s market. India, China, and Japan together use more than 70% of asia pacific’s asynchronous motor technology. The asia pacific region keeps growing in industry. There is strong need for asynchronous motor solutions in factories and energy.

Metric | Value / Detail |

|---|---|

India Market Valuation 2024 | USD 796.61 Million |

Global Market Valuation 2024 | USD 8.5 Billion |

Projected Global Valuation 2033 | USD 12.5 Billion |

Asia Pacific Market Share 2023 | 40% |

Asia Pacific CAGR (2026-2033) | 5.5% |

India’s asynchronous motor market is split by type and use. Big companies like ABB, Siemens, Hitachi, and Toshiba are important. The asia pacific induction motor market keeps getting bigger. This is because of more automation and energy-saving solutions.

Recent Growth

India’s asynchronous motor market is growing fast. The yearly growth rate is 7.89%. This is faster than many other asian countries. The asia pacific induction motor market may grow at over 6.9% each year from 2024 to 2032. India’s need for asynchronous motor technology in smart factories went up by 23.5% in 2023. People use more electricity each year, rising by 4.8%. This helps the market grow. The government supports green energy and better industry. This also helps the asynchronous motor market. The asia pacific region grows the fastest because of more factories and energy needs.

India is a leader in the asia pacific induction motor market. The country helps drive growth and new ideas in asynchronous motor technology.

Growth Drivers

Industrialization

Industrialization is changing the asynchronous motor market in India and Asia Pacific. More people are moving to cities. More factories are being built. This means there is a bigger need for good asynchronous motor solutions. India and China are leading this change. They have many factories and big building projects. These need three-phase asynchronous motors. Asia Pacific now makes 40% of all asynchronous motor money in the world. This shows that factories are growing fast in this area.

Manufacturing is growing fast. Big building projects help more people use asynchronous motor technology.

Factories want to work better and faster. This helps the market grow.

New asynchronous motor technology has smart features. This helps factories use Industry 4.0.

Renewable energy and electric vehicles also need more asynchronous motors.

There are some problems, like high costs and needing skilled workers. But the market is still growing because of more factories.

The World Economic Forum says the global industrial automation market will be $295 billion by 2025. This growth means more asynchronous motors are used in factories, building, and cars. Companies in Asia want to save energy. So, they use more asynchronous motors.

Energy Efficiency

Energy efficiency rules are very important for the asynchronous motor market in India and Asia. Governments have made strict rules to make sure motors save energy. The Indian Ministry of Power says new factories must use motors with IE3 or better. China wants to cut carbon emissions by 18% by 2025. This makes companies use better asynchronous motors.

People in Asia Pacific will use 3% more electricity each year until 2030. This is because of more factories and people moving to cities.

India’s Make in India and Smart Cities Mission help factories use better asynchronous motors.

Japan and South Korea have tough rules for energy efficiency. Upgrades cost a lot, but they save energy later.

If companies do not follow energy rules, they can get fines or be left out of the market.

Energy-efficient motors help save power and lower costs. ABB India made new IE4 and IE3 motors in 2024. This shows the industry cares about saving energy. Asia Pacific has 46.4% of the market because of more factories and energy rules. More companies use high-efficiency motors to follow rules and help the environment.

Electric Mobility

Electric mobility is a big reason the asynchronous motor market is growing in India and Asia. More people are buying electric vehicles. This helps asynchronous motor makers. India’s electric vehicle market is growing fast. Car companies are investing more. There are more charging stations now.

The government supports electric vehicles. More people in cities and a bigger population help more people buy EVs.

Car companies and tech firms work together. This makes electric vehicles better and increases the need for asynchronous motors.

China is the biggest market for EV motors in Asia Pacific. The government and car industry help this growth.

Asynchronous motors are used in cheaper electric vehicles. These are popular in India and other developing countries.

People want cleaner transport. The car industry is getting bigger. This helps the asynchronous motor market. New technology and government help make electric mobility grow. Asynchronous motors are important for the future of transport in Asia.

Asynchronous Motor Market Demand

The asynchronous motor market in Asia Pacific, including India, was about USD 2.5 billion in 2024. Experts think it will grow to USD 4.5 billion by 2033. The yearly growth rate will be 7.4% from 2026 to 2033. This strong growth is because of more factories, more people in cities, more manufacturing, and new buildings.

India is a top emerging market. It gets benefits from these trends. India keeps investing in new technology, renewable energy, and electric vehicles.

More factories use automation and smart manufacturing. Better power systems and more factory output help the market. The asynchronous motor market in Asia is strong. This is because companies want to save energy and use clean energy.

Year | Asia Pacific Asynchronous Motor Market Value (USD Billion) | CAGR (%) |

|---|---|---|

2024 | 2.5 | 7.4 |

2033 | 4.5 | 7.4 |

The asynchronous motor market is changing. Energy efficiency, more factories, and electric vehicles are the main reasons. The market will likely stay strong as Asian countries focus on automation, clean energy, and new ideas.

Regional Comparison

Asia Pacific Induction Motor Market

The asia pacific induction motor market is the biggest in the world. It makes up 40% of all asynchronous motor sales. This market is growing fast because more factories and cities are being built. Countries in asia spend a lot on making things, power plants, and transport. These investments help the market grow in cars, HVAC, and farming.

Asia’s strong economy helps the market get bigger. Governments have strict rules for energy efficiency, like IE4 and IE5. These rules make companies use better asynchronous motors. The market also grows because of electric vehicles and green energy projects. Sometimes, prices for materials and electricity change. This can affect the market, but it still grows overall.

The asia pacific induction motor market keeps getting bigger. Countries want more automation, to save energy, and to protect the environment.

China and Emerging Asian Motor Markets

China is the top country in the asia pacific induction motor market. In 2024, China has 45.5% of the market. India has 20.3%. China leads for many reasons:

The government says companies must use IE3 or better asynchronous motors. This helps save energy.

Big wind and solar projects need special asynchronous motors.

The Belt and Road Initiative builds more roads and buildings. This means more motors are needed.

China’s big factories and new technology help it stay ahead.

Other countries like South Korea and Vietnam also want more asynchronous motors. These places have more cities and factories now. They make products to sell to other countries. They need small, strong, and cheap asynchronous motors. More companies use energy-saving asynchronous motors, especially in big buildings and HVAC.

Some new trends in these markets are:

Smart asynchronous motors with sensors help check problems fast. This cuts downtime by 38%.

Small asynchronous motors are made for electric bikes and small EVs.

About one-third of new motors work with smart grids and IoT.

Some motors can change voltage and speed to fit different jobs.

Around 35% of new motors are safe for dangerous places.

Hybrid systems use asynchronous motors with digital controls and energy-saving parts. These are about 22% of new products.

These changes show that the market wants motors that save energy and work with new technology.

India vs. Asia

India’s asynchronous motor market is growing fast, but China is still number one. India has 20.3% of the market, and China has 45.5%. India grows because of programs like Smart Cities Mission and Make in India. These help use better asynchronous motors in water, HVAC, transport, and farming.

Country/Region | Market Share (2024) | Key Drivers |

|---|---|---|

China | 45.5% | Government rules, green energy, Belt and Road, big factories |

India | 20.3% | Smart Cities, Make in India, new buildings, better motors |

South Korea | ~8% | Export, energy saving, smart motors |

Vietnam | ~6% | More cities, small motors, more exports |

Japan | ~7% | High-efficiency motors, new technology |

Others | 13.2% | New asian markets, automation, modular motors |

India’s need for asynchronous motors keeps rising. The country spends more on new technology, green energy, and electric vehicles. The asia pacific induction motor market is different in each country. China leads because it has many factories and grows fast. India grows quickly because of new buildings and government help. Japan and South Korea focus on motors that save more energy. Southeast Asia is growing because of more factories and new roads.

The asia pacific induction motor market is always changing. China is big and has strong rules. India grows with new ideas and buildings. Other asian countries help the market with new trends in automation and saving energy.

Challenges

Regulation

Regulation affects the asynchronous motor market in India and Asia. Each country has its own rules. Companies must follow these rules to sell motors. This makes it hard to enter new places. They need to obey import and export laws, data privacy, taxes, ESG rules, and get special licenses. These things make it more expensive for every asynchronous motor manufacturer. India and Indonesia want companies to use new asynchronous motor models. This helps the market grow but adds pressure to meet strict standards. Making asynchronous motors with high-quality materials costs more money. Complex asynchronous motor designs also raise costs. Following all the rules adds extra expenses. Not enough skilled workers and lots of competition make it tough for asynchronous motor companies to earn money.

Rules are different in each Asia-Pacific country.

Import and export laws and taxes change asynchronous motor prices.

Energy-saving rules make companies upgrade asynchronous motors.

Following rules costs money and lowers asynchronous motor profits.

Supply Chain

Problems in the supply chain cause big challenges for the asynchronous motor market. There are not enough copper wire, rare earth magnets, steel laminations, and semiconductors. This slows down asynchronous motor production. Less steel from Africa means fewer parts for asynchronous motors in Asia. Political problems, tariffs, and export bans make it hard to get asynchronous motor parts. These issues make it take longer and cost more for every asynchronous motor producer. Manufacturers look for new suppliers, but this can cause delays and quality problems for asynchronous motor deliveries. Prices for copper and aluminum go up and down, making it hard for companies. They often charge customers more, which slows asynchronous motor sales in places where price matters. To help the market grow, companies find new sources, use smart tools, and work to make the supply chain stronger for asynchronous motor production.

Political problems make asynchronous motor parts cost more.

Changing prices for materials affect asynchronous motor costs.

Companies work to make the supply chain better for asynchronous motors.

Competition

Competition in the asynchronous motor market is very strong. Environmental rules make companies build better asynchronous motor models. This means they spend a lot on research and development for every asynchronous motor brand. Big companies and local ones all want a bigger part of the asynchronous motor market. Synchronous and servo motors also compete, but asynchronous motor solutions are still popular because they cost less and work well. Big industries like mining and power plants buy lots of asynchronous motors, so suppliers compete even more. Mergers and acquisitions help big companies get more asynchronous motor products and technology. Problems in the supply chain and high startup costs make things harder. Fast industrial growth and new buildings in Asia and India make more people want asynchronous motors, but also make competition tougher. New asynchronous motor technology, like variable speed control and smart features, helps companies stand out and grow the market.

Environmental rules push asynchronous motor companies to improve.

Big and small companies fight for asynchronous motor deals.

Other motors exist, but asynchronous motor solutions are most used.

New asynchronous motor technology helps the market grow.

Opportunities

Industrial Automation

Industrial automation gives many chances for growth in India and Asia-Pacific. More factories and new buildings make people want asynchronous motors. Big markets are cars, HVAC, and factory automation. Companies use smart asynchronous motors with sensors. These help fix problems before they happen and make work easier. Using variable speed drives helps asynchronous motors work better. Strict energy rules mean people want high-efficiency asynchronous motors. New technology makes asynchronous motors smaller and stronger for factories. India and China grow fast and spend money on new buildings. This helps them lead the market. Modern factories and tough rules make more chances for smart and custom asynchronous motors.

Factories and automation make people buy more asynchronous motors.

Smart asynchronous motors help fix problems early.

Variable speed drives make asynchronous motors work better.

Tough rules help sell more high-efficiency asynchronous motors.

Renewables

Renewable energy projects give new chances to asynchronous motor makers. Wind power uses asynchronous motors because they are strong and have high torque. Asia-Pacific is the biggest market, and India is important. More factories and electrification in India and Asia make people want asynchronous motors. Textile, cement, and chemical companies use energy-saving motors more now. Governments want local asynchronous motor makers and care about the environment. More electric vehicles and trains in Southeast Asia help the market grow. Wind and solar power need asynchronous motors because they save energy.

Government rules for saving energy make people change old motors to new asynchronous induction motors.

Smart Technologies

Smart technologies and IoT change the asynchronous motor market in India and Asia. Industry 4.0 makes people want smart asynchronous motors that can check problems and give data fast. Advanced factories use smart asynchronous motor technology. More electric vehicles and green energy make more chances for smart asynchronous motors. Governments and companies want motors that save energy and have sensors and controls. Big companies use smart technology to help with automation and saving energy.

Smart asynchronous motor technology and IoT help watch motors in real time.

More factories use smart asynchronous motors, so people want small three-phase asynchronous motors.

Energy-saving rules make people buy smart, energy-efficient asynchronous motors.

Key Players

Indian Leaders

India has many companies that make asynchronous motors. These companies help factories and cities grow. They sell many types of asynchronous motors for different jobs. Some top companies are Bharat Heavy Electricals Ltd (BHEL), Hindustan Electric Motors, ABB India Limited, Siemens Limited, Bharat Electric Motors, Kirloskar Electric Company Ltd., Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC), Marathon Electric India, and Bharat Bijlee Limited. These companies help with automation and building new cities. They make asynchronous motors for water, HVAC, and manufacturing. In 2024, the India electric motor market was INR 118.30 billion. Experts think it will reach INR 302.60 billion by 2034.

Multinationals

Big global companies also work in India’s asynchronous motor market. They focus on making motors that save energy and fit special needs. Some important multinationals are ABB India, Nidec Motor Corporation, Siemens Limited, and Toshiba Mitsubishi-Electric Industrial Systems Corporation (TMEIC). ABB India made new high-efficiency asynchronous motors in 2024. These motors are used in food, drinks, wastewater, HVAC, plastics, and rubber. Nidec Motor Corporation works with Ashok Leyland to make e-drive asynchronous motors for trucks and buses. They started a Centre of Excellence for new asynchronous motor technology. Siemens Limited spends money on research to make better asynchronous motors and help factories use automation. TMEIC works on smart asynchronous motor systems and connects them with IoT. These companies follow government rules to support local factories and save energy. They also use automation and IoT to make asynchronous motors work better and last longer.

Innovation

Innovation is important for the asynchronous motor market in India and Asia. Top companies spend money to make asynchronous motors better, smarter, and more useful. Some new trends are using advanced control technology like variable frequency drives and smart asynchronous motor controls. Companies make asynchronous motors with designs that can be changed for different uses. They also make small and light asynchronous motors for electric bikes and home machines. Some asynchronous motors are made for dangerous places and hybrid systems with digital controllers. Many new asynchronous motors can work with smart grids and be checked from far away.

Companies such as Siemens, ABB, Nidec, and Kirloskar Electric make new asynchronous motors that use less energy. Government rules and spending on buildings help people use eco-friendly asynchronous motors. This leads to more new ideas and chances for growth.

Future Outlook

Market Growth

India and Asia’s asynchronous motor market can get much bigger. Experts think the market will keep growing as factories and cities get modern. More people want asynchronous motors for HVAC, making things, oil and gas, and water cleaning. Squirrel cage asynchronous motors are still liked because they work well and last long. Companies like Siemens and ABB spend money to make motors smarter and save more energy. The market is moving to low-voltage, high-efficiency asynchronous motors. These changes help companies save money and protect the environment. Experts say the market will keep growing as more businesses use automation and energy-saving tools.

Asia Trends

Asia is number one for using and making new asynchronous motors. The region cares a lot about factory automation and saving energy. China and India are the biggest markets, but Vietnam, South Korea, and Japan are also growing fast. Asian governments have tough rules for saving energy, so companies must use IE3 and IE4 asynchronous motors. The market gets help from government plans like the Green Energy Corridor and rewards for electric vehicles. More companies want smart asynchronous motors with sensors and IoT. Asia’s market shows that digital tools, saving energy, and making things locally are very important.

Strategic Insights

People in the asynchronous motor market should use some smart plans. Working with top companies and spending on new digital and energy-saving ideas helps them stay ahead. About 42% of makers now focus on digital tools, and 33% spend money to make motors better. India’s market grows because the government wants more energy-saving and low-voltage asynchronous motors. People should follow these rules and buy automation and digital tools. Electric vehicles give big chances for the market, and this will keep growing until 2030. Some places, like Gujarat and Maharashtra, are strong for market growth. By following these ideas, people can find new chances and keep up with market changes.

The asynchronous motor market in Asia will keep changing as companies use new ideas, save energy, and go digital.

India’s asynchronous motor market is growing fast. This is because of more factories, saving energy, and electric vehicles. In Asia, China and India are the main leaders in this growth. People who work in this market should use some smart ideas to do well:

Watch asynchronous motor trends in India and nearby countries. This helps them keep up with new rules and reasons for growth.

Be ready for changes in the asynchronous motor supply chain and trade rules.

Make new asynchronous motor products that fit what local people need. They should also guess how much asynchronous motor demand will come from government plans.

Keep an eye on asynchronous motor rivals, new technology, and where people are investing. This helps them plan better.

If people pay attention to asynchronous motor news, they can find more ways to grow and avoid problems. The asynchronous motor market will keep changing as new asynchronous motor technology and rules come out. Companies that follow asynchronous motor trends closely will have more chances to grow and be leaders in the asynchronous motor market.

FAQ

What is an asynchronous motor and how does it work?

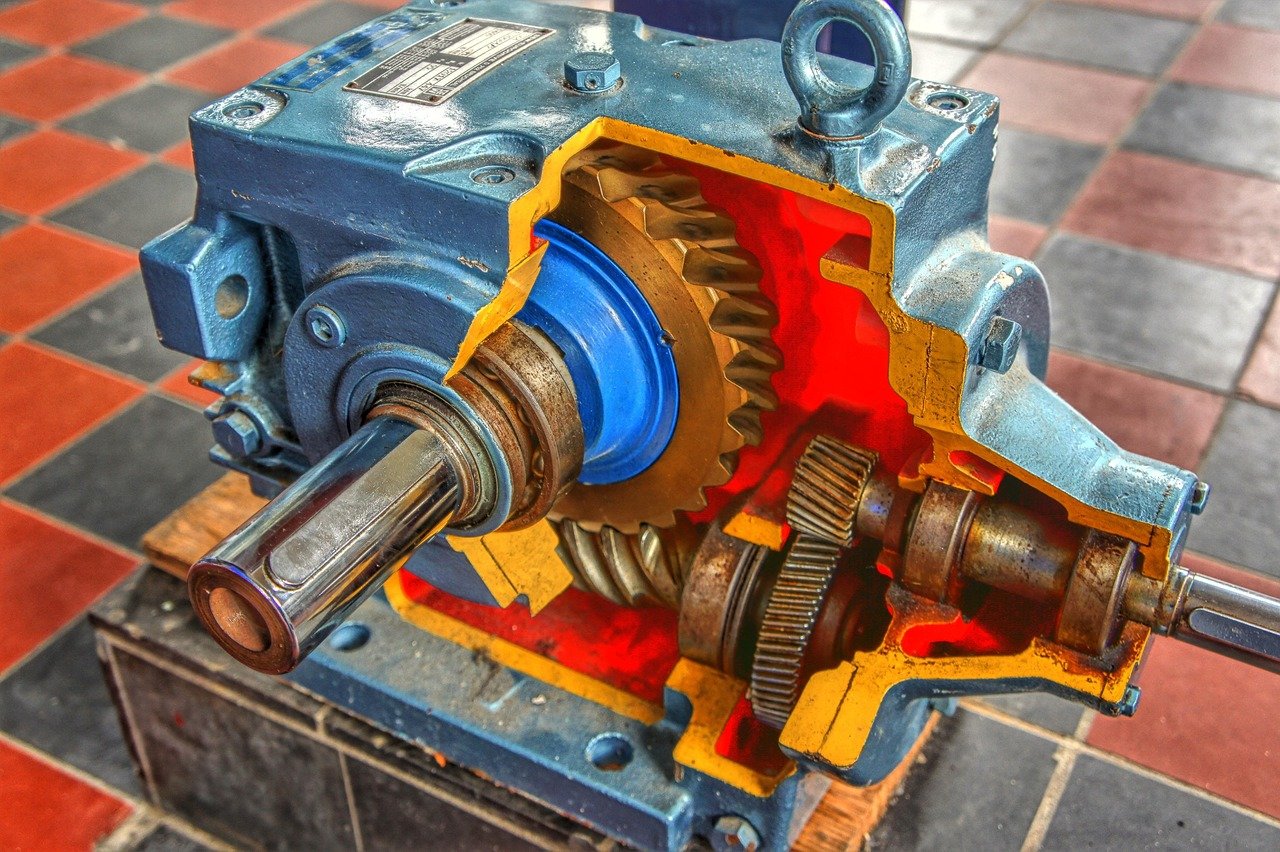

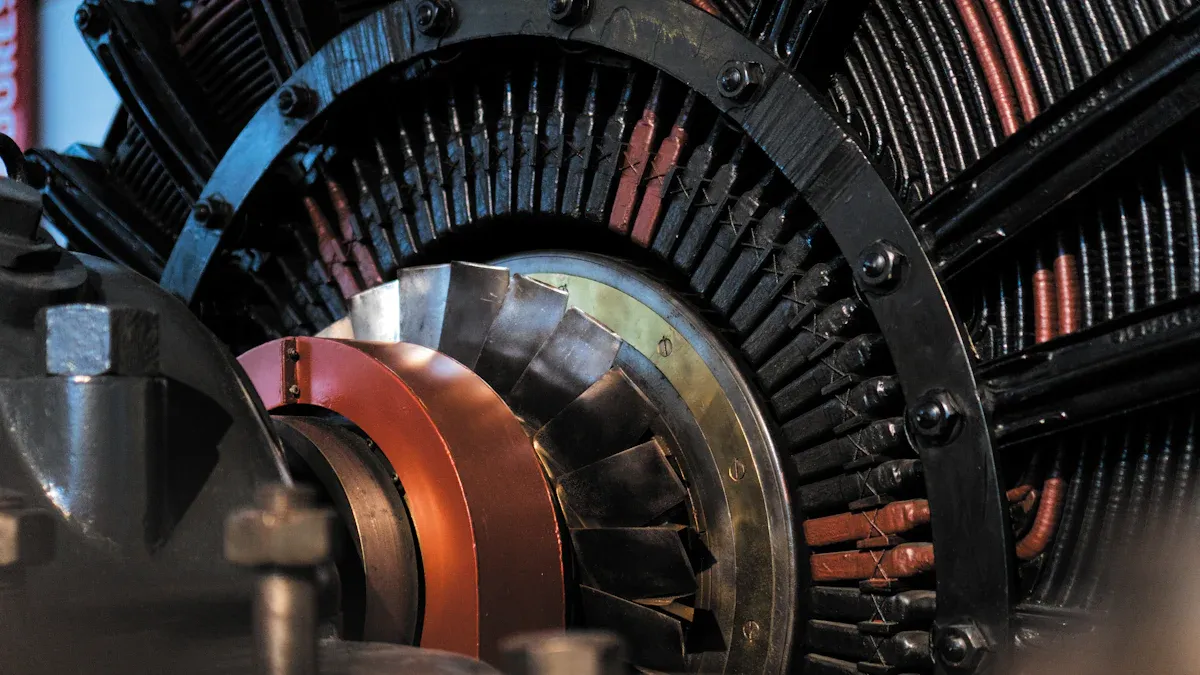

An asynchronous motor is a type of electric machine. It changes electrical energy into moving energy. The rotor spins at a different speed than the magnetic field. This speed difference makes torque. That is why asynchronous motor technology is trusted in factories and for automation.

Why is the asynchronous motor important for industrial automation?

The asynchronous motor works well and does not break easily. Factories use it because it can handle heavy work. It also helps with automation in making things. Companies pick asynchronous motor solutions because they last long and save money as factories grow.

How does an asynchronous motor support energy-efficient solutions?

An asynchronous motor has special designs to waste less energy. Makers build energy-efficient motors to follow strict rules. These motors help companies pay less for electricity. They also support energy-saving in factories, buildings, and green energy projects.

What are the main growth opportunities for the asynchronous motor market in India?

India’s asynchronous motor market grows because more people move to cities. Government rules and more need for automation help too. Growth also comes from spending on factory automation, green energy, and using iot in smart factories.

What are the latest forecasts for the asynchronous motor market in Asia?

Experts think the asynchronous motor market in Asia will grow a lot. They see more demand because of new factories, more cities, and the need to save energy. Companies believe the asynchronous motor sector will get bigger as more businesses use automation and digital tools.